CHARMING FARMHOUSE FOR RENT NEW heat/air, paint, and floor covering. Quiet Living, Stunning Views. $1,150/month. Dallas/Villa Rica. Call for more info. C. Moon 404-372-1350.

CHARMING FARMHOUSE FOR RENT NEW heat/air, paint, and floor covering. Quiet Living, Stunning Views. $1,150/month. Dallas/Villa Rica. Call for more info. C. Moon 404-372-1350.

LRA Plumbing Inc. Now Hiring SUPERVISORS, SERVICE TECHS, and HELPERS. Commercial and Residential Experience Preferred Benefits Call for details at 678-247-6990.

LRA Plumbing Inc. Now Hiring SUPERVISORS, SERVICE TECHS, and HELPERS. Commercial and Residential Experience Preferred Benefits Call for details at 678-247-6990.

MERCEDES & REPAIR SHOP located at 2823 Veterans Memorial Hwy SW, Austell, GA 30168

MERCEDES & REPAIR SHOP located at 2823 Veterans Memorial Hwy SW, Austell, GA 30168

Georgia Farm Bureau Mutual Insurance Company is seeking qualified applicants for the full- time position of Customer Service Representative in Paulding County. This position will assist the Agency Manager and assigned Career Agents, interact with policyholders on various insurance services, quote P&C coverage, bind P&C coverage according to insurance regulations and company guidelines, schedule appointments and perform other marketing duties as required.

Georgia Farm Bureau Mutual Insurance Company is seeking qualified applicants for the full- time position of Customer Service Representative in Paulding County. This position will assist the Agency Manager and assigned Career Agents, interact with policyholders on various insurance services, quote P&C coverage, bind P&C coverage according to insurance regulations and company guidelines, schedule appointments and perform other marketing duties as required.

We are a New Private Non-Medical Home Care Agency located in Dallas. Our Personal Care Services include ( ADL’s Bathing, dressing, oral care, shaving..etc) Companion/Sitter Care, Light Housekeeping, Meal Preparation, Errands/Shopping, Escort to Doctor appointments, Medication Reminders, Medication Pick-up, and Drop-off. Transportation Services to Senior Centers, Adult Day Centers, Church, Restaurants, Movies, etc. and more.

We are a New Private Non-Medical Home Care Agency located in Dallas. Our Personal Care Services include ( ADL’s Bathing, dressing, oral care, shaving..etc) Companion/Sitter Care, Light Housekeeping, Meal Preparation, Errands/Shopping, Escort to Doctor appointments, Medication Reminders, Medication Pick-up, and Drop-off. Transportation Services to Senior Centers, Adult Day Centers, Church, Restaurants, Movies, etc. and more.

Courtyard by Marriott Meeting and Event Space Available! 180 Barnes Ave., Carrollton, GA 30117 5 Floors, 101 Guestrooms, 8 Suites 2 Spacious Meeting Rooms Meeting space can be divided into two separate areas to meet your needs. 20% off Banquet Room 15% off Guest Rooms until the end of 2019 with this ad.

Courtyard by Marriott Meeting and Event Space Available! 180 Barnes Ave., Carrollton, GA 30117 5 Floors, 101 Guestrooms, 8 Suites 2 Spacious Meeting Rooms Meeting space can be divided into two separate areas to meet your needs. 20% off Banquet Room 15% off Guest Rooms until the end of 2019 with this ad.

Summer is here at last. For many people, it’s time to get the car ready for a long road trip. And with GPS-enabled smartphones, it’s now a lot easier to navigate these drives without getting lost. During your life, you may take many journeys – one of which is the long road you’ll travel toward your financial goals. But even on this path, you can benefit from a “GPS” in the form of your goal-oriented, personalized strategy.

Summer is here at last. For many people, it’s time to get the car ready for a long road trip. And with GPS-enabled smartphones, it’s now a lot easier to navigate these drives without getting lost. During your life, you may take many journeys – one of which is the long road you’ll travel toward your financial goals. But even on this path, you can benefit from a “GPS” in the form of your goal-oriented, personalized strategy.

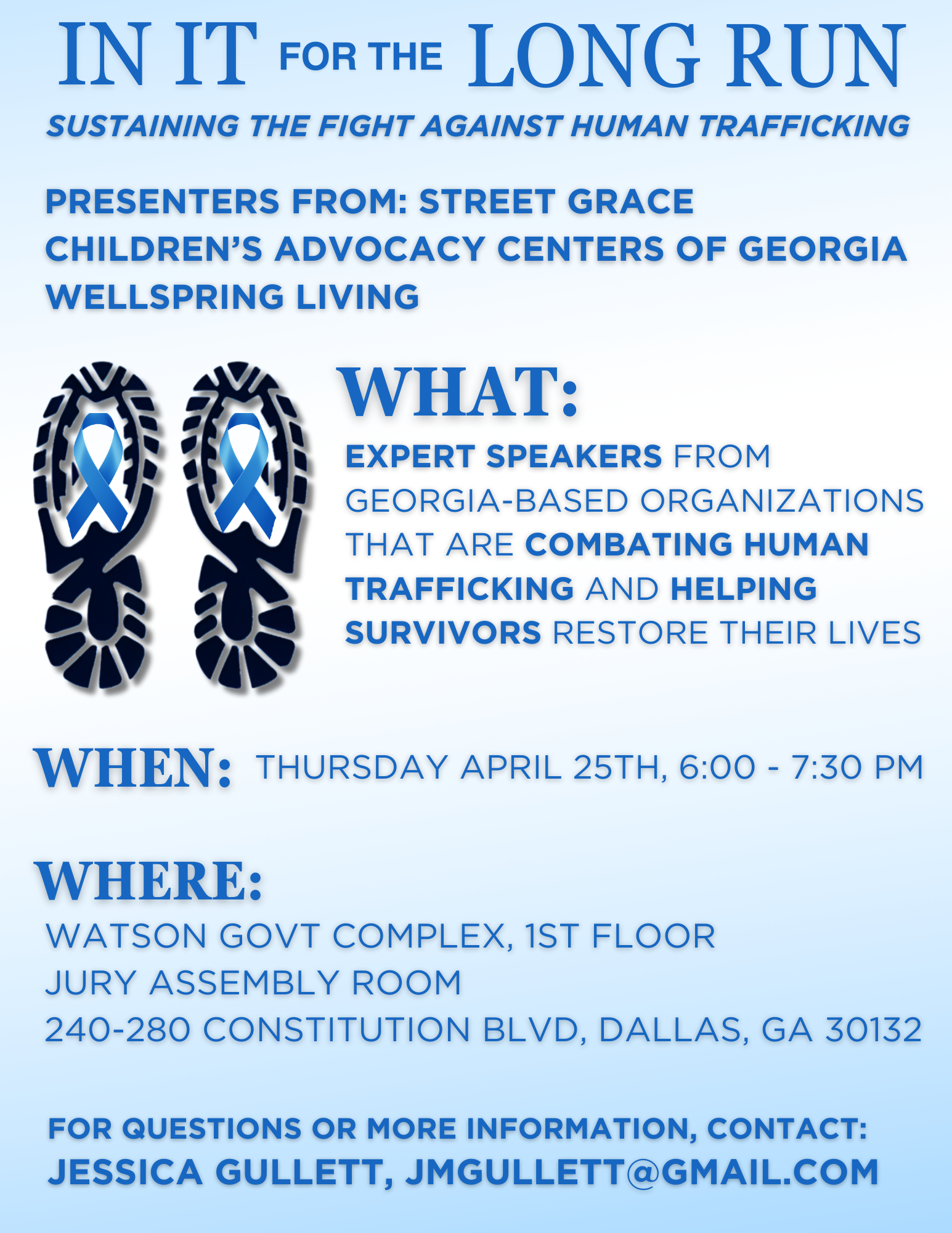

Tin Bucket Mercantile has so much to offer: from colorful wall art to classic handbags, kooky socks, and shirts to elegant home accents. One corner features a mini cafe that offers sweet treats like Macarons and classic bottled Cokes perfect for relaxing after exploring the mercantile.

Tin Bucket Mercantile has so much to offer: from colorful wall art to classic handbags, kooky socks, and shirts to elegant home accents. One corner features a mini cafe that offers sweet treats like Macarons and classic bottled Cokes perfect for relaxing after exploring the mercantile.

If you work for a business that offers a 401(k) plan, consider yourself fortunate, because a 401(k), with its tax advantages and variety of investment options, is a great way to save for retirement. But what if you need to tap into your plan before you retire? Is it a good idea to borrow from your 401(k)?

If you work for a business that offers a 401(k) plan, consider yourself fortunate, because a 401(k), with its tax advantages and variety of investment options, is a great way to save for retirement. But what if you need to tap into your plan before you retire? Is it a good idea to borrow from your 401(k)?

It’s almost impossible to save too much for retirement. After all, you could spend two, or even three, decades as a retiree. And retirement is not cheap – even if you maintain a relatively modest lifestyle, some of your expenses, especially those involving health care, may continue to rise over the years. Consequently, you will need several sources of reliable income – one of which might be a fixed annuity.

It’s almost impossible to save too much for retirement. After all, you could spend two, or even three, decades as a retiree. And retirement is not cheap – even if you maintain a relatively modest lifestyle, some of your expenses, especially those involving health care, may continue to rise over the years. Consequently, you will need several sources of reliable income – one of which might be a fixed annuity.

If you were to receive a sizable inheritance, what should you do with it? This money could help you achieve some of your important financial goals – so you’ll want to think carefully about your choices. Of course, everyone’s needs are different, so there’s no one “right” way to handle a large lump sum.

If you were to receive a sizable inheritance, what should you do with it? This money could help you achieve some of your important financial goals – so you’ll want to think carefully about your choices. Of course, everyone’s needs are different, so there’s no one “right” way to handle a large lump sum.

When it’s time to do your estate planning – and it’s actually never too soon to begin – you may find the process, at first, to be somewhat bewildering. You’ll have many questions: What sort of arrangements should I make? Who should get what? And when? How can you address these and other issues?

When it’s time to do your estate planning – and it’s actually never too soon to begin – you may find the process, at first, to be somewhat bewildering. You’ll have many questions: What sort of arrangements should I make? Who should get what? And when? How can you address these and other issues?

International Women’s Day will be observed on March 8. Around the world, special events will celebrate the cultural, social, political and economic achievements of women. However, this last area – economic progress – is one that still causes concern, and rightfully so, because women still face gender-related challenges.

International Women’s Day will be observed on March 8. Around the world, special events will celebrate the cultural, social, political and economic achievements of women. However, this last area – economic progress – is one that still causes concern, and rightfully so, because women still face gender-related challenges.

As you work toward achieving your goals in life, you will need to make moves that contain financial, tax and legal elements, so you may want to get some help – from more than one source. Specifically, you might want to put together a team comprised of your financial advisor, your CPA or another tax professional, and your attorney. Together, this team can help you with many types of financial/tax/legal connections.

As you work toward achieving your goals in life, you will need to make moves that contain financial, tax and legal elements, so you may want to get some help – from more than one source. Specifically, you might want to put together a team comprised of your financial advisor, your CPA or another tax professional, and your attorney. Together, this team can help you with many types of financial/tax/legal connections.

To say the financial markets were a bit bumpy in 2018 may be an understatement. The S&P 500 was down 6.2 percent for the year, the first time this key index fell since 2008, during the financial crisis. So what can you anticipate in 2019? And what investment moves should you make? Let’s review the causes of last year’s market volatility.

To say the financial markets were a bit bumpy in 2018 may be an understatement. The S&P 500 was down 6.2 percent for the year, the first time this key index fell since 2008, during the financial crisis. So what can you anticipate in 2019? And what investment moves should you make? Let’s review the causes of last year’s market volatility.

Think about your loved ones. What will their future be like? Can you picture them living in your house for many years from now? Can you picture your children going to college? Can you picture your spouse or partner enjoying a comfortable retirement? These are all pleasant visions – but what if you weren’t in these pictures?

Think about your loved ones. What will their future be like? Can you picture them living in your house for many years from now? Can you picture your children going to college? Can you picture your spouse or partner enjoying a comfortable retirement? These are all pleasant visions – but what if you weren’t in these pictures?

For many years, employees of companies that offered 401(k) plans only faced a couple of key decisions – how much to contribute and how to allocate their dollars among the various investment options in their plan. But in recent years, a third choice has emerged: the traditional versus Roth 401(k). Which is right for you?

For many years, employees of companies that offered 401(k) plans only faced a couple of key decisions – how much to contribute and how to allocate their dollars among the various investment options in their plan. But in recent years, a third choice has emerged: the traditional versus Roth 401(k). Which is right for you?

How can you assess your investment portfolio’s performance in 2018? The year was full of wild swings in the financial markets, so your own results may well have bounced around quite a bit, too. But you can still get a clear picture of how you did if you keep your investments’ returns in the proper perspective by making sure your expectations are relevant, realistic and reviewed.

How can you assess your investment portfolio’s performance in 2018? The year was full of wild swings in the financial markets, so your own results may well have bounced around quite a bit, too. But you can still get a clear picture of how you did if you keep your investments’ returns in the proper perspective by making sure your expectations are relevant, realistic and reviewed.

As the year winds down, you may want to look ahead to see which areas of your life you can improve in 2019. Perhaps you’ll decide to exercise more, eat healthier foods, reconnect with old friends or volunteer at a school or charitable organization. All these goals are certainly worthwhile – but you also may want to add some New Year’s financial resolutions to your list.

As the year winds down, you may want to look ahead to see which areas of your life you can improve in 2019. Perhaps you’ll decide to exercise more, eat healthier foods, reconnect with old friends or volunteer at a school or charitable organization. All these goals are certainly worthwhile – but you also may want to add some New Year’s financial resolutions to your list.

It probably doesn’t happen as much as you’d like, but you may occasionally have some extra disposable income. For example, perhaps you have recently received, or will soon receive, a year-end bonus. Or maybe you will get a sizable tax refund in just a few months. Wherever this money comes from, you will want to put it to good use. Should you use the cash to pay down debts or should you invest it instead?

It probably doesn’t happen as much as you’d like, but you may occasionally have some extra disposable income. For example, perhaps you have recently received, or will soon receive, a year-end bonus. Or maybe you will get a sizable tax refund in just a few months. Wherever this money comes from, you will want to put it to good use. Should you use the cash to pay down debts or should you invest it instead?