It’s College Savings Month: How Are Atlanta-Area Families Saving?

By Mitch Seabaugh, executive director, Path2College 529 Plan

September is officially College Savings Month in the state of Georgia and across the nation. That means, for 30 days, state college savings plans—like the Path2College 529 Plan, financial planners, colleges, universities and many others associated with higher education, work to inform families about the opportunities they have to plan for the future and to help focus attention on the need for saving for future higher education expenses.

You’ve heard the numbers:

- In 2017, families spent an average of $23,757 on higher education (according to “How America Pays for College 2017” by Sallie Mae and Ipsos)

- Between 2011-12 and 2016-17, published tuition and fee prices rose by nine percent in the public four-year sector, by 11 percent at public two-year colleges, and by 13 percent at private nonprofit four-year institutions, after adjusting for inflation (Trends in Higher Education, CollegeBoard.org)

- The average cost of tuition and fees for the 2016–2017 school year was $33,480 at private colleges, $9,650 for state residents at public colleges, and $24,930 for out-of-state residents attending public universities. Additionally, room and board ranged from $10,440 at four-year public schools to $11,890 at private schools; and books and supplies averaged just over $1,200. (according to the College Board)

There are countless additional examples of why saving for college is wise. However, results from the Sallie Mae and Ipsos study showed that while 86 percent of families always knew their child would go to college, only 39 percent of families made a plan to pay for it. Additionally, according to a 2017 TIAA study, nearly two-thirds (63 percent) think saving for college education should begin at birth, but only 26 percent of parents begin saving for education at their child’s birth; and 80 percent of respondents say saving should begin before the age of six, but only 46 percent begin saving before their child turns six years old.

You know saving for college is something most parents contemplate. But what do the numbers really look like in Georgia?

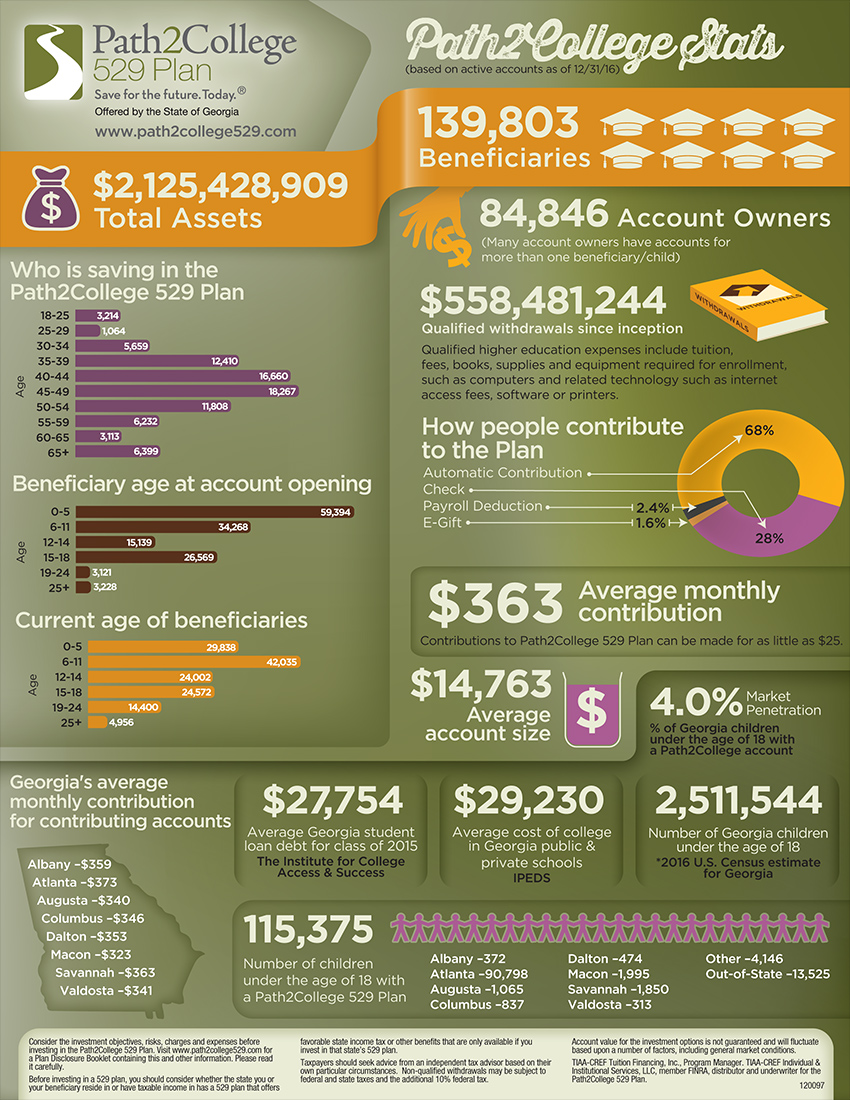

More than 150,000 accounts have been opened and more than $2.4 billion saved in the Path2College 529 Plan. Investing in the Path2College529 Plan has already paid-off for the more than 37,000 beneficiaries whose families have withdrawn more than $622 million for qualified higher education expenses. (Data as of 7/31/17.)

Here is a breakdown of how people are saving in the state of Georgia’s Path2College 529 Plan in the Atlanta-area (Data based on active accounts as of 12/31/16).

- Number of Accounts*: 113,001

- Average Monthly Contribution: $373

- Average Account Size: $14,805

- Number of Children Under the Age of 18 with a Path2College Account: 90,798

- Age of Beneficiary/Child with Path2College Account: 0-5 Years: 24,218 6-11 Years: 32,896 12-14 Years: 18,473 15-18 Years: 19,169 19-24 Years: 11,213 25-plus Years: 3,889

So how do we solve this problem? I want to encourage families to look at their saving options, and begin saving TODAY. Studies show that simply having a college savings account makes your child three times more likely to attend college and four times more likely to graduate than if they did not have one. (http://www.ihep.org/better-together, May 2017) For families that already have a Path2College 529 Plan, consider annually increasing your college savings contributions and make sure you are on track to achieve your college savings goals by utilizing the Path2College 529 Plan calculator at https://www.path2college529.com/tools/calculator/.

While it is often unreasonable to plan to save 100 percent of the college of college, a realistic goal for many families is to save 25 percent of projected college expenses. If this isn’t possible, save as much as you can. For as little as $25 a month, you can invest in your loved ones future by saving in a Path2College 529 Plan, and this small investment can have a tremendous impact over time. Remember, every dollar saved is one less dollar you may need to borrow.

Consider the investment objectives, risks, charges and expenses before investing in the Path2College 529 Plan. Visit www.path2college529.com for a Plan Disclosure Booklet containing this and other information. Please read it carefully.

Check with your home state to learn if it offers tax or other benefits for investing in its own 529 plan.

Taxpayers should seek advice from an independent tax advisor based on their own particular circumstances. If the funds aren't used for qualified higher education expenses, a 10% penalty tax on earnings (as well as federal and state income taxes) may apply.

Investments in the Plan are neither insured nor guaranteed and there is the risk of investment loss.

TIAA-CREF Tuition Financing, Inc., Program Manager. TIAA-CREF Individual & Institutional Services, LLC, member FINRA, distributor and underwriter for the Path2College 529 Plan.